The Prevailing Belief

The prevailing belief in academe, the world of finance, and even on Main Street is that central banks can quash inflation by raising interest rates. In fact, in the midst of rising inflation, the US Federal Reserve recently confronted whether it acted too slowly in raising interest rates to curtail the money supply.1See “Fed Confronts Why It May Have Acted Too Slowly on Inflation,” New York Times, May 10, 2022. This theory, which was first put to the test in 1979 during what is known as the “Volcker Shock,” claimed that increasing the interest rate would decrease the quantity of money in the economy, and that this in turn would curb inflation. However, as we shall see, the money supply was largely unaffected by interest rate fluctuations, so this theory does not account for any changes in inflation that occurred at the time. Increased interest rates may in fact have contributed to inflation. However, the belief that higher interest rates will kill inflation remains near sacrosanct across the political divide and, like any religious system, is barely subject to serious empirical scrutiny.

The belief in the power of central banks to quash inflation is largely based on overly simplistic neoclassical assumptions of supply and demand mechanics in a market economy. The narrative goes: if inflation is the result of too much money chasing too few goods and services—a version of the Quantity Theory of Money (QTM) asserted by monetarists such as Milton Friedman, Karl Brunner, and Allan Meltzer2Monetarist theorists at the St. Louis Federal Reserve Bank in particular formed a sort of radical pressure campaign on the Federal Open Market Committee (the FOMC), urging them to adopt reserve balance and money supply targets as their chief monetary policy targets. They furthermore urged them to become more loose with the range in price of overnight borrowing and hence the range that interest rates in general were allowed to occupy. The FOMC’s eventual acceptance of monetarist policy ideas in 1979 was hailed as a major victory for monetarists at the St. Louis Fed and elsewhere. –Eds—in order to dampen prices, the central bank must restrict the money supply by increasing interest rates, or by targeting the money supply directly by restricting the supply of reserves to commercial banks.3The modern version of this argument rests upon another concept from neoclassical economics called the “money multiplier,” which is essentially the ratio between the amount of commercial bank money that is allowed to be created by banks relative to the amount of central bank money – “reserves” – they are required to hold in their accounts with the Federal Reserve. A certain fraction of total money created by banks must be “backed” by reserves (related to yet another concept from mainstream economics called “fractional reserve banking”) and central banks, it is believed, can control the amount of lending that is happening by setting reserve requirements for commercial banks. As we show below in the discussion on bank lending and the Fed’s practices during the Volcker Shock, this reserve mechanic is faulty. Banks certainly face constraints in their lending such as the amount of capital they must hold to cover any bad loans (loans that aren’t repaid) that may be issued, however reserve availability is not among their constraints. –Eds 4See “The Truth About Inflation: Why Milton Friedman Was Wrong, Again,” Evonomics, November 24, 2021 (accessed 7/6/2022) and Kliesen, Kevin L and David C. Weelock (2021) ‘Managing a New Policy Framework: Paul Volcker, the St. Louis Fed, and the 1979-82 War on Inflation’ Federal Reserve Bank of St. Louis Review, First Quarter, (1), pp. 71-97. This makes taking on debt more expensive and paying back existing floating interest rate debt more difficult.

You may be wondering what exactly the money supply is. In basic terms, it is the creation of new money in the economy – whether it’s physical printed money, or money that exists solely in balance sheets. The lay person may be surprised to learn that the quantity of money in an economy is increased primarily when new loans are taken out.5For our magazine’s own summary of how banks create money through loans – also known as the endogenous money theory – see John Michael Colón & Steve Mann, “What Should Money Be Made From?” in Issue One. –Eds. Most new money in an economy is created and allocated not by central banks but by commercial banks extending loans to willing borrowers, like people, corporations, and governments. With few exceptions, these loans are done digitally when a commercial bank expands its balance sheet by recording the loan as an asset to be paid back with interest.6Werner, Richard A. (2014) ‘Can Banks Individually Create Money out of Nothing? – The Theories and the Empirical Evidence’ International Review of Financial Analysis, Vol 36: 1-19. Werner, Richard A. 2014. ‘How do Banks Create Money, and Why Can Other Firms Not Do the Same? An Explanation for the Coexistence of Lending and Deposit-Taking’ International Review of Financial Analysis, Vol 36: 71-77.

The prevailing belief about interest rates and inflation was first tested in 1979 after the US Federal Reserve Chairman, Paul Volcker, let the federal funds rate fluctuate and targeted the money supply in its first ‘War on Inflation’ from 1979 to 1982.7See Susan George’s masterful classic, A Fate Worse than Debt (16 November 1988). This period is referred to as the Volcker Shock and is often cited as empirical proof that hiking interest rates will bring down inflation. Volcker explained his (and the board of the Federal Open Market Committee’s (FOMC)) shift towards targeting the money supply directly in order to tame inflation in a press briefing following an emergency meeting:

The Federal Reserve for some years has ordered a good deal of its emphasis in actual day-to-day operations to maintaining a high degree of stability in the Federal Funds rate which we most directly influence. That rate, of course, has been influenced in one direction, but generally by small increments in order to effect[sic] the growth in the money supply. Now what is implied here is a somewhat difference [sic] approach where the primary emphasis is put on the supply of reserves which ultimately controls the money supply. I don’t want to suggest that the control is so precise that it works week by week or even with precision month by month. But by emphasizing the supply of reserves and constraining the growth of the money supply through the reserve mechanism, we think we can get firmer control over the growth in the money supply in a shorter period of time —greater assurance of that result. But the other side of the coin is in supplying the reserves in that manner, the daily rate in the market — the rate without in itself great economic significance — is apt to fluctuate over a wider range than has been the practice in recent years. We at the Federal Reserve will take less interest, if you will, in the daily fluctuations of that very short-term rate [emphasis mine].8Transcript of Press Conference Held in Board Room, Federal Reserve Building, Washington, D.C. (1979). FRASER database, Federal Reserve Bank of St. Louis.

This marked an important conceptual shift by the Federal Reserve. Whereas prior to 1979 the Fed would choose a federal funds rate to target and then let its measures of the money supply fall wherever they may, the new method would be the reverse: the Fed would choose a level for the money supply (in this case, the amount of reserves that banks must hold in order to settle payments between each other), and then let the federal funds rate fall wherever it may, instead.9The new interest rates set by the Fed, would be calculated from a desired quantity of reserves, and by extension money in the economy. Given that this policy was adopted specifically to combat inflation, where the Fed desired to reduce the quantity of money in the economy, the interest rate would necessarily increase. Pegging the quantity of money and allowing the interest rate to fluctuate, instead of the inverse, would supposedly trigger prices to normalize to fewer available dollars.

A number of factors led to rising inflation in the United States by 1979, namely: oil price fluctuations, union wage increases, Vietnam war spending, and fiscal deficits. During the oil price shocks of 1973 and 1974, the price of a barrel of oil increased by 400%, leading to an increase in the cost of manufacturing and transporting some 6000 goods made with crude oil. Furthermore, it was believed that the wages of unionized workers increased due to inflation and that subsequent increases in wages lead to further generalized price increases to accommodate the operational costs of higher wages (leading to a “wage-price spiral”10The “wage-price spiral” is a common conservative talking point used to bargain down union labor. A great example of its recent use can be found in the following interview of union leader and rail worker Eddie Dempsey on Jeremy Vine. The second interviewer in particular blames inflation primarily on wage increases or the “wage-price spiral” ignoring other factors that affect the CPI and inflation. https://www.youtube.com/watch?v=6fZe6Pq4hn4). Vietnam War spending, Johnson’s Great Society program, and fiscal deficits increased the amount of money in circulation, presumably leading to “too many dollars chasing too few goods.”

But while central bankers were certainly aware of these factors, Volcker and other central bankers adopted the quantity theory of money (QTM)11See “Notes Toward a Theory of Inflation” by Steve Mann in Strange Matters Issue One (Summer 2022) for a lengthier explanation of the QTM. alone to explain inflation and their subsequent policies. In short, what we could call ‘the Volcker Shock theory of interest rates and inflation’ is anchored in the QTM and the assumption that increasing the interest rate decreases the number of new loans issued and therefore the volume of new money in circulation, which in turn decreases prices. But is this long-held view accurate?

Virtually no one has considered the reverse hypothesis—that when central banks increase base interest rates this contributes to inflation rather than quells it. At first, this hypothesis may sound like blasphemy against the church of orthodox monetary policy, but it is worth consideration in the current climate where central bankers are again hiking interest rates with the belief that slowing the money supply will mitigate inflationary pressures on prices.

To investigate this hypothesis, I will first consider some theoretical arguments before moving on to an empirical examination of our best test case—the Volcker Shock.

Cost-Push Dynamics and Inflation

Debt is an essential element of modern economies and is a significant operational cost. Modern capitalist economies rely on credit to function: most businesses and households require business loans, mortgages, and other loans to function, and have operational costs which include servicing these loans. As witnessed during the 2008 Global Financial Crisis, if trust in the future of the economy is jeopardized (and by extension trust in loans being repaid), credit freezes up, bankruptcies and bailouts begin, and recessionary conditions follow. Limiting credit or refusing to extend credit can lead to devastating consequences for individuals, families, businesses, and even governments.12If Modern Monetary Theorists are correct, the federal government would only do so because they hold the operationally mistaken belief that it must borrow more of its own fiat money at higher rates in order to finance itself and would “pay for” this increased expense by increasing tax revenue, fines, and fees. Why exactly central banks choose the policies they do remains an open question in political journalism and economic theory alike. –Eds We can think of debt (for better or ill) as the backbone of modern capitalist economies and the servicing of debt as a ubiquitous operational cost.13Tim Di Muzio & Richard Robbins, Debt as Power (2017).

Businesses in modern capitalist economies also typically use cost-plus accounting systems. Cost-plus means that corporations determine the cost of what they sell and then add a mark-up to meet a profit target. Mark-ups of course vary depending on the sector of the economy, the power of the firm, industry traditions, competition and the scarcity and desirability of the product or service. For example, Figure 1 is a list of the mark-ups for thirty of the largest companies by market value.14See Jonathan Panciano & Sarah Hansen, “The World’s Largest Public Companies 2019: Global 2000 By The Numbers,” Forbes (15 May 2019) (Leonie Noble’s calculations.)

So, businesses and firms administer their prices in a cost-plus fashion, but how does this relate to debt and interest rates? It should not be a secret that most non-financial businesses take on debt for a variety of reasons. But whatever the reason, the interest on the loans taken out are an operational cost to businesses. Given that modern corporations adopt a cost-plus system of accounting, this means that businesses will tend to push these increases in cost onto the consumer: more expensive interest payments will get pushed onto consumers through increases in the prices of goods and services. These are called cost-push dynamics. It is improbable that businesses would decide to absorb the more expensive cost of credit because this would be a bad earnings strategy over the medium to long-term and would not please shareholders and owners. In a situation where banks are lending—albeit more expensive credit—we can expect the prices of consumer products to rise as a result of interest rate hikes from central banks.15That is, unless a business chooses to offset the increased cost of servicing debt by some other means, like decreasing wages. Figure 2 charts the mounting debt of corporate firms to commercial banks in the US and the yearly interest they pay for debt from 1965-2021.

How do higher interest rates affect mortgage holders? Most mortgage holders know that the cost of servicing their mortgage (or mortgages in some cases) will go up. This in turn pushes the cost of housing up for renters,16Renters could end up paying more in rent as a result of higher interest rates because despite not being on the hook for a mortgage of their own, they are essentially on the hook to pay their landlord’s mortgage. first-time home buyers, and those on adjustable interest rates or who renew their mortgages during a rate increase.

How do interest rate increases affect government deficit spending or debt? More expensive credit could ultimately mean greater taxes and the privatization of public assets to shore up the budget and appear fiscally responsible to voters. The problem here is that eventually you run out of assets to sell, and higher taxes can drain money from the disposable income of individuals and families.

Having laid out my theory, let me proceed to its consequences. If the above analysis holds – as there’s good reason to believe it does from studying business operations – then it would seem to be the case that raising interest rates, to the extent it would affect prices at all, would raise them. That is, these prices would largely (but not exclusively) increase because capitalism is a credit-based economic system and interest gets “cost-pushed” onto consumers. Depending on their level of power, corporations can also administer or engineer prices to meet specific profit targets. Price is not just a signal for consumer behavior but a means of profit.17Jonathan Nitzan and Shimson Bichler (2009) Capital as Power. (London: Routledge). Conflicts such as the war in Ukraine, international supply chain disruptions, the speculation of investors, a global pandemic, and labor shortages may also contribute to rising prices.

Inflation is differential in that all prices do not rise together in one swift movement – with perhaps one exception: increases in the cost of oil.18Blair Fix, “The Truth About Inflation” on Economics From the Top Down (24 November 2021) Modern capitalist economies are energy intensive and heavily reliant on oil, natural gas, and coal. If these costs increase, as oil and natural gas recently have, this will have a knock-on effect on almost all prices.

Thus far, we have considered the theoretical arguments for why a central bank’s monetary policy of increasing interest rates could exacerbate rather than quell inflation across the economy. But what of the empirical evidence? I first investigated this question in my book Carbon Capitalism: Energy, Social Reproduction, and World Order (2015), in which I studied the inflationary periods following oil price shocks in 1973 and 1979.

Examining the Volcker Shock More Closely

Let’s begin by considering M2—a measure of the quantity of money in the United States economy—leading up to and a bit after the Volcker Shock of 1979. M2 includes cash, money in bank accounts, and easily-convertible near money such as money market securities.19We know you may be wondering, “How is it that there are ‘measures of money’? Don’t we know how much money exists in an economy because it gets printed by the mint?” Well, printed money makes up only a portion of the money that exists in bank ledgers. This is why, earlier in this essay, it is mentioned that when people and entities take out loans money is created – no new money is printed, yet it exists in balance sheets and in the debtor’s newly acquired purchasing power. “But don’t loans need to be backed by equivalent funds held by a bank?” In short – no! For more on these and other often overlooked questions about money, read our series on the history of chartalism. –Eds

If the prevailing belief about inflation and the interest rate is true, we ought to see that in the data. We’d expect to see that an increase in interest rates slows or drastically curtails the increase in quantity of money in the economy, which is demonstrably not the case in Figure 3. The quantity of money continues to grow despite interest rate spikes.

Now let’s zero in on the accounting logic. Consider a hypothetical firm borrowing with interest owed to a commercial bank in one scenario, who in another scenario receives an interest free loan. Let’s say the owners of Margarita Mix Co. want to make 100 bottles of margarita mix for sale on the market. They also want to achieve a 30% mark-up on costs as they hear this is the industry standard.

In scenario 1 the owners would have to charge $5.36 per bottle if they wanted to realize a 30% profit rate. In the second scenario, with no interest to pay, the owners would only have to charge $4.06 per bottle to earn their 30% profit. Given that the vast majority of corporations operate in a similarly cost-plus accounting system, and servicing loans is a ubiquitous operational cost, increases in interest rates can and almost certainly do lead to inflation.

The increase in M2 during the period under study shows that raising the federal interest rate has little if any impact on the money supply. Figure 4 shows the federal interest rate and the consumer price index (CPI) in the same period.

If increasing the federal funds rate has a precipitous impact on the consumer price index you certainly do not see it here. Instead, we see an increase in the price of goods that becomes more rapid across the period. If the relationship between interest rate and inflation followed the prevailing belief, we would see declines in the consumer price index as interest rates soar, or we would at least see the graph becoming less steep. We do not see this at all. Rather we see the reverse: the CPI continues to climb with an increasing federal interest rate.

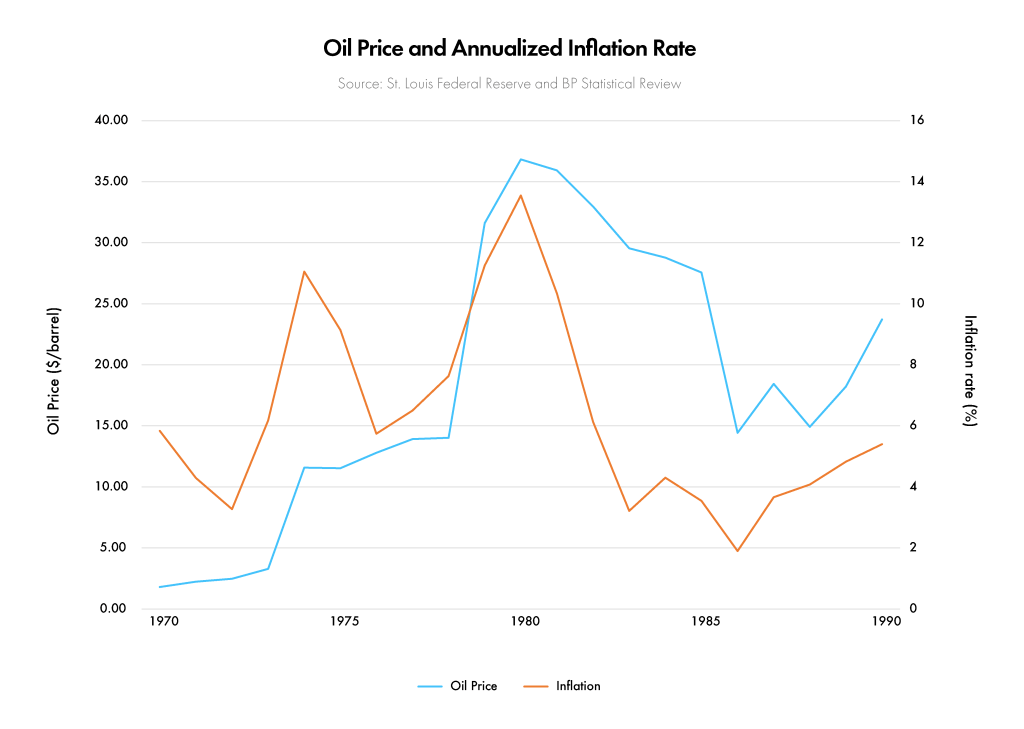

It is often claimed that the Chairman of the US Federal Reserve, Paul Volcker, successfully wrung high inflation out of the United States economy. But could other factors account for the decline in inflation more directly? Could it be that inflation soared in the United States primarily because of the oil shocks of 1973 and 1979, and then subsequently came down as oil prices started to decline? Crude oil is used to transport and manufacture over 6000 everyday products.20See “Uses For Oil” on the Canadian Association of Petroleum Producers website (capp.ca) Oil prices and inflation should exhibit a relationship during the period under study.21It should be noted that the period under study is before globalization – specifically, before the opening of Eastern Europe and China to Western capitalists, an event which provided cheaper labour pools for corporations to exploit. Figure 5 shows the price of oil and inflation from 1970 to 1990.

Though they aren’t a perfect match, it is clear that increases in the oil price correlate pretty closely to inflation; and when oil prices start to decrease, inflation appears to drop. A story that explains the inflation of the 70s by emphasizing the causal role of the oil crisis thus makes a good deal of sense.

But can you really say the same about a story that emphasizes the causal role of interest rates? If the federal interest rate is charted against inflation, what is the result? Here we can judge mainstream neoclassical theory by its predictive power. If the prevailing beliefs regarding inflation were true, we’d expect to find inflation decreasing when interest rates are increased. So, if we plot it out what do we see?

Figure 6 charts the federal interest rate against inflation and shows a close correlation between the two which is a positive correlation, not an inverse one. This is a problem for neoclassical theory. It suggests that increasing interest rates contributes to rather than diminishes inflation. When the federal funds rate starts to drop, inflation also decreases. Again, this should not be surprising in a capitalist economy fuelled not only by oil but also by interest-bearing credit—two key drivers of business costs and therefore price inflation. But in either case, what affects prices is pretty obviously business cost; the effects of the “money supply” on prices, if they’re to be seen at all, seem to be almost exactly the opposite of what monetarist theory would have predicted.

Now let’s dig even deeper and see if the relation can’t be made even more clear. For example, what happens if we lag the data22In econometrics (a subdiscipline of economics), to “lag” an explanatory variable means to move it backwards or forwards in a time series you are investigating (either uniformly or based upon some function you devise) because you believe that while it does have an impact on the dependent variable you’re studying, you think that there is a time delay between when the explanatory variable happens and when the dependent variable responds. After you’ve implemented the lag, you can compare how well the lagged model fits the data relative to the unlagged model. If your hunch was correct, then the proof will show up statistically in higher correlations for the lagged model. In the case examined above by Di Muzio, lagging the data shows an even tighter correlation between the two variables of rising interest rates and rising prices. He proceeds to speculate on what could account for this. –Eds – and why would we do that? Well, you’ll notice that the data for price increases lines up much more nicely (particularly during the Volcker years) with data for interest rate increases if you move it forward in time by a year. Let’s take a look at figure 7, which does precisely this.

Why might this be? There could be any number of reasons. As you can see from Figure 8, it might be because of the confounding factor of movements in oil costs. Or, it could show that businesses are expecting interest rates to go up, anticipating an attendant increase in their costs, and raising prices preemptively. Either way, however, it continues to indicate that price rises and interest rate rises go together. If in fact increasing the federal funds rate has any effect on prices, it’s likely precipitating an increase in the rate of inflation.

What Control does the Fed Have Over Inflation?

This article has challenged—both theoretically and empirically—the prevailing wisdom that central banks can control the rate of inflation by increasing interest rates in a modern economy highly reliant on oil and credit for the production of goods and services. As suggested in the beginning of this article, central bankers certainly know that there are other factors which contribute to inflation, however chairman Volcker and his monetarist peers, focused on the quantity of money in circulation as the overarching reason for price increases. This widely held belief is still with us today as central bankers in the United States, the UK, Australia, Canada, and elsewhere are trying to control inflation by limiting the money supply and increasing interest rates.

As Volcker and the Federal Reserve board members observed during the 1979 Volcker Shock, attempting to target the money supply failed even on its own terms: businesses need credit to operate, regardless of any tinkerings of the Fed with money dials. Given that loans continued to be issued, the money supply continued to increase in tandem with increases to the federal funds rate. The underpinning theory was that a lower money supply would decrease inflation. Since the money supply continued to increase, this cannot account for any downturn in inflation that occurred. There were, however, other consequences of the interest rate fluctuations. Overnight debt markets went haywire as businesses (anticipating increased costs of borrowing) scrambled to obtain the financing they needed. Furthermore, their profit margins were squeezed, or the new costs of borrowing were pushed onto the consumer.

When businesses face widespread unanticipated increases to their costs that they cannot reliably pass onto consumers or to other businesses with whom they work, it can eventually lead to recessions, as seems likely to have been the case during the inflationary periods examined in this essay. In a perverse way, this is “lowering prices” by “raising interest rates” – though the mechanism is rather different and more catastrophic than the idea that prices “adjust” to a change in the monetary supply. When the Fed raised its target rate it could have indirectly caused businesses to set their prices lower – but only because the higher business costs associated with interest rate increases sparked a recession, and firms tend to lower prices on the onset of recessions (the disinflationary effects of which are very well-studied – firms needing to sell increased inventories at whatever price possible in order to pay down debts incurred at higher interest rates, for example), rather than because of the interest rate hikes or the money supply themselves.

This has grisly implications for the present conjuncture. My research suggests that in the short run, raising interest rates could actually make inflation worse, as business cost increases from rate hikes get passed to consumers. But in the medium to long term, when businesses can no longer raise their prices further with any success, they might simply shut down production and lay people off; which will mean fewer consumers with money in their pockets, and so fewer profits for firms; which will lead to yet more firms shutting down, etc – the familiar deflationary spiral of a traditional recession. The good news, if you can call it that, is that when firms see a depression coming they tend to lower prices. The bad news is that you’re now in a recession, with all the mass unemployment and shuttered workplaces and lack of investment that implies. Thus, the Fed will have succeeded in lowering prices, by annihilating the economy. It will have fixed a stubbed toe, by amputating the foot. And what’s worse, given the deep roots of the present inflation in supply chain issues, there’s no guarantee a recession would even lower key prices at all. An interest rate hike is a non-solution at best, and fuel to the fire at worst.

The present-day Federal Reserve Chairman Jerome Powell23Interestingly, Chairman Powell is not an economist. He is an attorney with extensive experience in investment banking and a net worth of approximately $50 million. He is also a Republican despite the sitting Democratic president. -Eds has been urged by his fellow elites to mimic Volcker to “tame inflation” with successive sharp increases to the federal funds rate without regard for the conditions of labor markets or even financial markets (only this time using the inflation-targeting neoclassical consensus as his theoretical underpinning, thereby striking an interestingly non-monetarist tone). As the argument and evidence herein suggest, Chairman Powell will likely find, as Volcker ought to have found before him, that he cannot control inflation at all, and that he has possibly exacerbated it.

EDITOR’S NOTE (9/1/2022): We have amended the piece in order to clarify the exact significance of Chart 7, which was misleading as originally stated.